Last week, we shared a 5-step process to help you identify the biggest expenses within your brokerage. If you missed that, you can revisit it here.

Today, we’ll be introducing a decision-making process to help you decide which expenses to cut vs. keep.

By following along with each article in this series, you’ll have a clear direction on reducing your brokerage expenses and increasing your profit margins.

Plus, you’ll be putting more thought into your brokerage’s expenses than the vast majority of your competitors. (Trust us, very few brokerages take the time to do this!)

Let’s dive right in.

Foundation

If you followed the steps in last week’s article, you’ll now have a list of your biggest expenses and expense categories, within your brokerage.

Typically, expenses that fall under rent & occupancy, salary & payroll, and advertising are often the largest within a brokerage. You may also have large software or legal expenses (we know that E&O claims are… “fun”) that add to your overall expense structure.

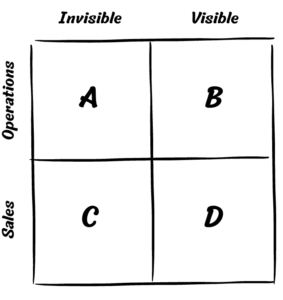

A simple and effective method to start brainstorming expenses that can trimmed is called the Visible & Invisible Quadrant.

(If you want a copy of the quadrant, you can download it for free here. Or you can simply copy it on a piece of paper.)

As you can see, all expenses are separated into two buckets: Sales or Operations. Additionally, each expense is further labeled as either “visible” or “invisible.”

This makes reviewing expenses a lot easier to digest.

Visible expenses are expenses that either your staff or your agents would immediately notice. Expenses that fall within this category can impact morale, positively or negatively.

Invisible expenses are expenses that your staff or agents wouldn’t notice whatsoever. Oftentimes, they’re legacy expenses that brokerages continue to pay because they always have.

Step 1: Categorize Your Expenses

Take a moment to fill in all the expenses from your list in its appropriate quadrant.

Here are some examples to help get you started:

- Sales: Invisible → Digital Ad Vendor

- Operations: Invisible→ Cleaning crew that comes in every two weeks.

- Sales: Visible → CRM that your agents use.

- Operations: Visible → Getting rid of one of the copy machines in the office.

Step 2: Force Rank + Questions

With your list complete, it’s now time to prioritize your expenses using 3 key questions:

- What are the most significant expenses in each quadrant?

- How quickly can I reduce this expense?

- Which expenses are vital to sales or operations vs expenses that aren’t?

Step 3: Start Cutting Expenses!

After you’ve identified, categorized, and force ranked all your expenses, it may be tempting to cut out the largest expenses first.

But not so fast.

Larger expenses need to be thought through carefully and most likely can’t be cut right away.

Instead, cutting many smaller expenses first can add up quickly and they’re easier to cut as they generally don’t have a large impact on your business.

We recommend always targeting expenses in the Invisible quadrant first as eliminating them won’t affect the company or its morale one iota.

After you’ve cut all the invisible expenses that you can, move onto Visible expenses.

Visible Expenses Reduction/Elimination Treatment

For all Visible expenses, we strongly encourage you to make a strategic plan with set dates to make changes.

Additionally, when cutting Visible expenses, effective communication within your brokerage is paramount. Be clear and direct in explaining why you’re making these cuts. Discuss overall impacts to the company; positive and/or negative.

Failure to do so may result in misunderstandings and future headaches.

When making an announcement, follow this simple format:

- Start with the facts.

- Clearly state the problem.

- Discuss its impact on the company.

- State the solution.

- Discuss the decision-making process and why it is a better solution.

- Discuss the roll-out and set realistic dates. NEVER overpromise. It’s better to say that something will take 90 – 120 days publicly when realistically it may be completed in 90 days. Give yourself a reasonable cushion because issues often will and do arise.

- Continue to “over communicate” progress every week.

Let’s say you’re rolling out a new CRM system that’s 25% less expensive and can better fit the needs of your company. Here’s an example of what an announcement would look like:

“Hey everyone, every year we take a look at our tools and systems to make sure that we are utilizing the best ones for our company. We don’t always make changes, but this year we will.

Over the past six months we have noticed a steep decline in usage of our current CRM and have fielded and addressed many complaints. Well – we heard you.

We have looked at many different CRM systems and it came down to two: ABC and XYZ. Both are really good and directly address many of the issues that we’ve been having, but the customer service in XYZ is clearly superior.

So, after many hours of searching and many meetings later, we are excited to announce that we will be rolling out XYZ. Because this is a big change, we have come up with a roll-out plan that is not overwhelming.

All of us we be fully trained and realistically, we are planning to roll out the software over the next four months. We could roll it out faster of course, but we want to get this right. It will help all of us.”

Bonus Tip: Recruiting Play

Annual expense reviews can also be a compelling angle when recruiting new agents.

You can highlight your commitment to maintaining a healthy business that benefits both agents and clients.

For example, you could say something like:

“We strive for excellence in our company in all areas. We know that you, the agent, are our #1 priority. In fact, we treat all our agents as our customers.

What sets us apart from all other brokerages in this market is that we have tools, systems, processes, and talent to deliver an exceptional customer experience – to you.

Because every year we look at every single vendor, tool, software, and overall operations to assess if there is something better that can help to improve our overall customer experience to you.

Again – you are our #1 priority and instead of just trusting us at face value – let us show you. You will not be disappointed.”

Summary

Wow! You’ve done a lot!

Here’s a recap of everything you’ve done, including Part 1:

- Gathered a minimum of 2 years of P&L statements.

- Identified the company dollar/gross profit for each year.

- Found the 3 biggest expense categories for each year.

- Calculated the ‘Total {Expense} as a Percentage of Revenue’ for each expense for every year.

- Compared the ‘Total {Expense} as a Percentage of Revenue’ against each other.

- Listed all your biggest expenses in the Visible & Invisible quadrant

- Force-ranked those expenses

- Started cutting expenses!

We hope you found this expense review exercise helpful.

This exercise that we’ve outlined should be done annually. You may not need to make large reductions or changes every year, but the exercise itself can prove very beneficial to the company.

If you ever need additional help, feel free to reply to this email, and we’ll be happy to answer your questions.

P.S. – We’re excited to announce a FREE upcoming video series that dives deeper into this very topic. Let us know if you are interested and we will put you on our list.

If you found this useful, we encourage you to sign up for The ClaytonWolf Report. You’ll receive articles like this in your inbox every Thursday. Sign up here: https://nut.sh/ell/forms/329583/OWrbCM